Early this year, I got the 2011 edition of Best European Fiction. The idea of the best European fiction is inherently idiotic, like the best city, the best university or the best food.

A few stories I read were sophomoric and just plain bad. So out went the book. But I remember the struggle of the editor to define Europe in the introductory chapter; I suppose you have to do it if you are editing a book of European fiction.

He got nowhere. Anyone setting out to define Europe through the commonality of themes in fiction is setting himself up for failure because there is no such commonality.

Europe, first and foremost, is an economic entity and must be understood as such. Even in the midst of an economic crisis which points to that fact – can you imagine a linguistic crisis in Europe, or a moral or cultural crisis? – that obvious fact is overlooked – or not understood at all.

Hegel showed that we think in names. “Given the name lion, we need neither the actual vision of the animal, nor its image even. The name alone, if we understand it, is the unimaged simple representation. We think in names“, he wrote in Philosophy of Mind.

What do we think of when we think Europe?

We think of Beethoven’s symphonies, Newton’s mechanics, Italian architecture, French cuisine, the Dutch masters. We think Mozart, Hegel, Faraday, French Revolution.

These names resonate with us because our lives in some way are impacted by them. The nature of that impact does not concern us here. But note that all the names are clustered in a region that is geographically Western Europe. That is no coincidence. The countries in Western Europe were the first to emerge from a feudal society into a capitalist state. It is that socio-economic transformation that defines Europe and its place in the world. Europe is the Capitalist Europe; note how the names are also clustered around a specific time – roughly the 18th century – which corresponds to the rise of Capitalism.

The degree of the Europeanness of the countries in the continent is measured with that yardstick. Unsurprisingly, that measure correlates with the geography and the physical proximity of the countries to the Western European center. Using the parlance of the current crisis, we can say that there are “core” and “periphery” countries in Europe.

Correlation, though, is not causation. It does not contain the element of necessity. We cannot always infer a country’s stage of economic development from its position on the map. Art and literature are better indicators. They more accurately reflect the economic and social relations in a country because they are born out of those relations.

Take Spain and Portugal which both began the road to Capitalism early but then fell behind their northern rivals.

To date, they are less Europe. If you do not live in Portugal, you would be hard pressed to think of a universally recognized European icon that is Portuguese.

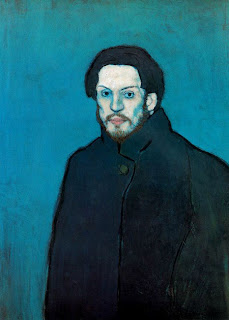

As for Spain, the example of Picasso will suffice. His success is precisely due to the fact that he is Spanish, a lifetime spent in France notwithstanding. John Berger, in his masterly exposition of Picasso in The Success and Failure of Picasso hits on this very point: Picasso being a “vertical invader” of the European stage from the trapdoor that was Barcelona:

Poverty is not surprising to any Spaniard. But the poverty Picasso witnessed in Paris was of a different kind. In the Paris self-portrait of 1901 we see the face of a man who not only is cold and hasn’t eaten much, but who is also silent and to whom nobody talks.Hungary is not Europe. As a part of the Austro-Hungarian Empire, it came in touch with the European core and was set on its way to Capitalism. It is all there in Musil’s masterpiece, The Man Without Qualities. He describes a country in which “there was some show of luxury, but by no means as in such overrefined ways as the French. People went in for sport, but not as fanatically as the English. Ruinous sums of money were spent on the army, but only just enough to secure its position as the second-weakest among the great powers.”

Nor is this loneliness just a question of being a foreigner. It is fundamental to the poverty of outcasts in a modern city. It is the subjective feeling in the victim that corresponds exactly to the objective and absolute ruthlessness that surrounds him. This is not poverty as a result of primitive conditions. This is poverty as the result of man-made laws; poverty which, legally accepted, must be dismissed from the mind as unworthy of any consideration.

Many peasants in Andalusia must have been hungrier than the couple at the table in the etching of The Frugal Meal. But no couple would have been so demonized, no couple would have felt themselves to be so worthless.

WWI aborted the transformation and later, under socialism, semi-feudal relations survived. Socialism did not destroy them with the vehemence that capitalism would have. You can see that in the beautiful novels of Sandor Marai, in Casanova in Bolzano or Embers.

In Embers, a man’s sense of honor prevents him from opening the diary of his long-dead wife, although it would answer a question which has been tormenting him for 40 years.

Imagine Rupert Murdoch – the hacker of dead schoolgirls’ cell phones – being restrained by a sense of honor. Or Tony ‘Yo’ Blair. Or David Cameron. Sarkozy. Berlusconi.

Berlusconi!

I am not talking about the leaders and outstanding citizens only. Western European writers in general could not think of the idea of leaving a dead wife’s diary unopened. Nor would their readers believe such a plot; it would make no sense to them. That is because sense of honor is not only internal, but also external: it springs from a concern and respect for the others. It is ultimately the recognition of others as one’s equals. A “rational” Western man who is conditioned to view maximizing one’s profit at the expense of others as the natural order of the universe would reject that equality even if his life depended on it.

It is in that sense that Hungary is not Europe: a strong sense of honor is still conceivable there.

And Greece is not Europe. Greece most definitely is not Europe.

Geographically, Greece is attached to Turkey. It was a part of Turkey for 400 years. But it is not geography alone; if Turkey could qualify as a North Atlantic country in NATO, then Greece could qualify as a European country. I am talking about economic and social relations.

In both respects, Greece is closer to Turkey and Iran than France and Germany. The commonality goes beyond baklava and stuffed grape leaves. It pertains to the balance of power between business and the government from which, ultimately, the country’s social relations and the tempo of its daily life originates. You can see that in the disorganization of the social institutions perfectly reflected in traffic. It is the hallmark of a society which has not internalized the discipline of the assembly line – or the call centers, as the case may be.

Because business – Capitalism – in Greece is relatively underdeveloped, the government has assumed the economic functions that in more developed economies are left to the businesses. That further accentuates the relaxed mood of the country and acts as a brake against the “entrepreneurial drive” that is so evident in the West and, especially, in the U.S.

Until the new reforms kicked in, for example, the Greek government paid the full pension of deceased pensioners to the surviving spouse. And if the couple had children under 18, they too, were paid until they turned 18. Turkey and Iran have similar laws.

To the advocates of family values in the West, that is a scandal, a paternalistic restraining of the free people’s spirit which had to change if Greece was going to join the ranks of civilized nations.

That is precisely what the EU and euro are all about. The issue is not the core countries. They are already European. The plan is make the periphery core. Why? Because in less developed periphery countries labor is cheap. Given a common currency, the core countries can exploit that advantage to raise the rate of return of capital.

For that to happen, the government in the periphery countries must get out of the way and make room for business – after making the conditions right for the business to come in.

That is what the racist professor whom I quoted in Part I was saying about Greece. Let us hear him one more time:

A European country without a land registry, without proper tax enforcement and without a responsible political process to control spending and borrowing needs all the outside pressure it can get to increase state capacity ... Pressure to improve state capacity and become a grown-up country is what Germany and European Union are currently providing, free of charge.Exactly. The Greek government must establish a land registry so that property rights could be unquestionably asserted. It must establish proper tax collection to enforce tax payment from small businesses and the middle class and, most important of all, reign in the spending. What a scandal, paying for the living expenses of a child just because his parents are dead.

This is what has been happening in all periphery countries.

As for the governments getting out of the way, they have no alternatives. Just listen to Jacob Funk Kierkegaard, at the Peterson Institute of International Economics in Washington. He was quoted in the Financial Times of July 22:

Absent a dramatic improvement in the business climate or Greece raising money by selling off its islands, I still think it is going to be a struggle to get investors to have confidence in Greece with such a high level of debt burden.Greece raising money by selling its islands!

But I am getting ahead of myself.